If you’ve been hurt and received money from a personal injury settlement, you might be wondering how it will affect your food stamps, also known as SNAP benefits. It’s a valid concern because receiving a lump sum of money can change your eligibility for government assistance programs. This essay will break down the key factors that determine whether your settlement will impact your food stamps, offering clarity on a potentially confusing topic. We’ll look at how SNAP works, how settlements are treated, and what you can do to stay informed.

How SNAP Works: The Basics

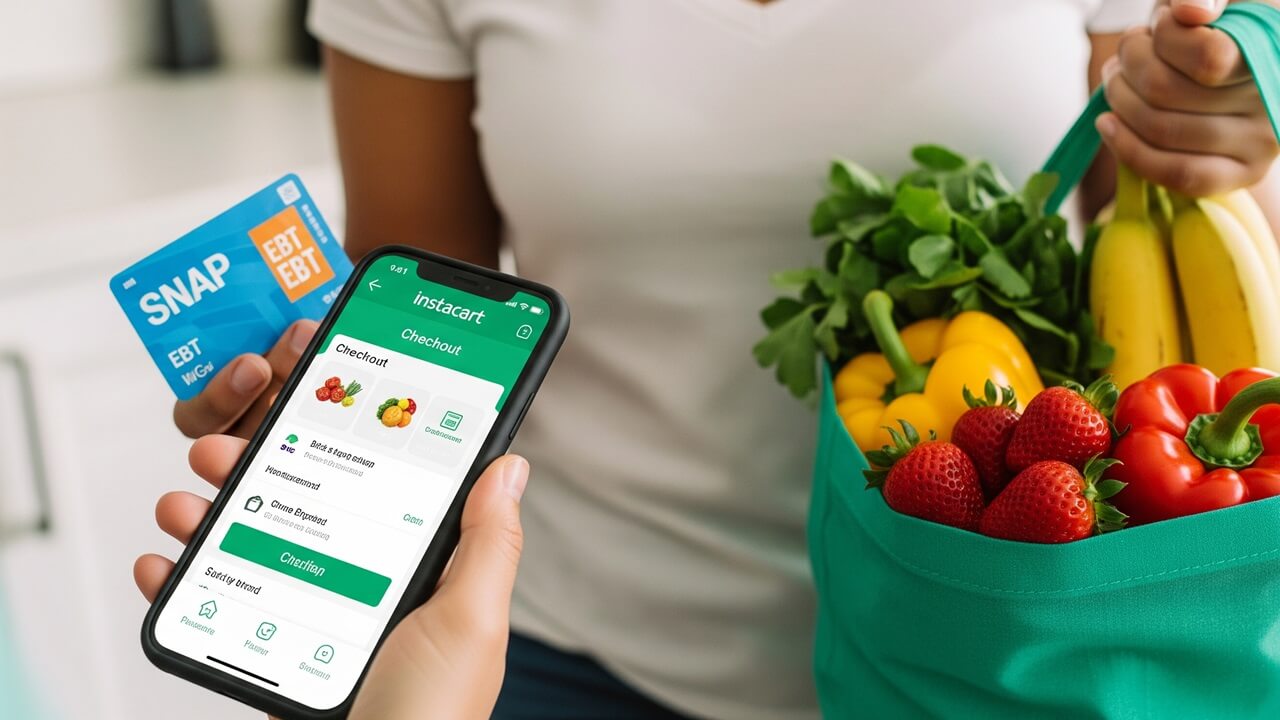

The Supplemental Nutrition Assistance Program (SNAP) helps people with low incomes buy food. It’s run by the government and provides benefits through an Electronic Benefit Transfer (EBT) card, which works like a debit card at grocery stores. To get SNAP benefits, you have to meet certain requirements, like having a low income and limited resources. Resources include things like money in your bank account, stocks, and bonds. SNAP is there to give people a little extra help so they can eat healthy meals.

SNAP eligibility rules vary a little bit from state to state, so it’s essential to know your local rules. Most states use income and asset limits to decide who qualifies. This means there is a maximum amount of money you can have in your bank accounts and other resources. Income includes things like wages from a job, unemployment benefits, and other sources of money. SNAP programs want to make sure the people who need it the most are getting the help they need.

It is important to know that changes in your financial situation, like receiving a personal injury settlement, must be reported to your SNAP caseworker. This helps to ensure that the benefits you receive are accurate and that you’re following all the rules. Not reporting changes can lead to problems, such as overpayments, penalties, or even the loss of your SNAP benefits. SNAP wants to make sure people are getting the help they need, but also that people are following the rules.

Will a personal injury settlement affect your food stamps? Yes, it can, but the extent depends on several factors. The way the settlement is handled, and its impact on your overall resources, will influence your eligibility for SNAP benefits.

How Settlements Are Considered as Resources

When you get a personal injury settlement, the money is considered a resource. Resources are things you own that could be converted into cash. SNAP programs look at your resources to decide if you’re eligible for benefits. Money is often considered a liquid asset, meaning it can be easily accessed and spent.

Typically, there are resource limits that you need to follow. If you go over these limits, you might not be eligible for SNAP, or your benefits could be reduced. These limits change, so it’s a good idea to know the most up-to-date information from your local SNAP office. When the money from a settlement is added to your resources, it could potentially put you over the limit, impacting your SNAP benefits.

There are a couple of things that you can do with settlement money that might affect how it is viewed. If you put your settlement money into a trust, it could be protected from counting as a resource. Speak with a legal professional to ensure compliance. Also, some specific expenses paid for with the settlement money, like medical bills related to the injury, might not count against your resource limit. That is why it is very important to keep all of your financial records.

Here are some examples of things that may or may not be included in the resource limits:

- Money in a savings account: Included

- Cash on hand: Included

- Stocks and bonds: Included

- A home you live in: Usually excluded

- Vehicles: Typically excluded, depending on value and use

The Timing of the Settlement and SNAP Benefits

When you receive your personal injury settlement matters. It’s not just about the total amount of money but also when you get it in relation to your SNAP benefits. If you receive the settlement during the period you are already receiving SNAP, it could impact the benefits you’re getting right now. Your caseworker will need to know about the settlement to determine if your benefits will change.

If you apply for SNAP benefits after you’ve received your settlement, the money you have will be considered when deciding if you’re eligible. They’ll look at your current resources, including the settlement money. Even if you used some of the settlement money before applying for SNAP, the amount remaining might still be a factor in eligibility. Always report all income and assets when applying for SNAP.

It’s crucial to communicate with your SNAP caseworker as soon as possible. Inform them about your settlement, so they can assess the situation. It’s always better to be upfront and honest. This can help avoid any confusion or problems later on. They can help you understand how the settlement might affect your benefits and what steps you can take.

Here’s a simplified timeline of how the timing can work:

- You receive the settlement.

- You report it to your SNAP caseworker.

- The caseworker reassesses your eligibility, taking into account your resources.

- Your SNAP benefits may be adjusted, or you may become ineligible.

What Expenses Can Be Deducted from the Settlement?

Sometimes, certain expenses related to your personal injury settlement can be deducted before they consider the amount when assessing SNAP eligibility. These deductions can reduce the overall amount of your settlement that is counted as a resource, potentially impacting your benefits. It’s important to be aware of the types of expenses that might qualify for a deduction.

Medical expenses directly related to the injury, such as doctor’s bills, hospital costs, and prescriptions, are common deductions. These expenses are often considered essential, and deducting them helps ensure you have the resources to cover your medical needs. Legal fees and court costs, also associated with the settlement, may also be deductible. These fees are a necessary part of the process and can be subtracted before calculating your available assets.

Other costs, such as transportation expenses related to medical treatment, can be deducted. These expenses can be significant, and deducting them recognizes the financial burden they place on you. It’s always important to keep good records of all of your expenses, including receipts and other documentation, so that you can provide proof when needed. The more detailed your records are, the better your case for deductions.

Here is a breakdown of potential deductions:

| Type of Expense | Deductible? |

|---|---|

| Medical Bills | Yes |

| Legal Fees | Yes |

| Transportation for Medical Treatment | Maybe |

| Living Expenses | No |

The Impact on Your Monthly SNAP Benefits

Receiving a personal injury settlement can affect your monthly SNAP benefits, but it doesn’t always mean you will lose all your benefits. The amount of the settlement, along with your other financial resources, will determine how much your benefits might change. Depending on the size of your settlement, your benefits could be reduced, or you might become ineligible for SNAP.

The caseworker will recalculate your benefits based on your current resources. They’ll add the settlement money to your existing assets and then determine if you still meet the eligibility requirements. If your resources exceed the limits, your benefits will be adjusted. If you exceed the limits, your benefits will be adjusted, and you may no longer be eligible.

Sometimes, even if your benefits are reduced, it’s not necessarily a permanent loss. After the settlement money is spent or used for qualifying expenses, you may regain eligibility, which means you may be able to reapply. Be prepared for potential adjustments to your benefits and understand that these adjustments are based on your current financial situation. Always contact your caseworker for clarification.

Let’s say your household’s asset limit is $3,000.

- If you have $2,000 in the bank and then get a $5,000 settlement, your total assets become $7,000.

- Since $7,000 is over the asset limit, your benefits will be impacted.

- If you spend $4,000 on qualifying medical expenses, your assets will be reduced to $3,000.

- You might then qualify for benefits again.

How to Report the Settlement to Your SNAP Caseworker

Reporting your personal injury settlement to your SNAP caseworker is a very important step. It’s how you keep your benefits in good standing. Being honest and providing all the necessary information makes the process go smoother. You can avoid any potential penalties or misunderstandings that might occur if you don’t report.

The most important thing is to notify your caseworker as soon as you receive the settlement. You will typically need to provide documentation, like a copy of the settlement agreement, bank statements showing the deposit, and any other documents relating to the settlement. It is always better to gather as much information as possible. Keep copies of everything you send to your caseworker for your records.

Make sure you fill out any forms your caseworker gives you completely and accurately. Answer any questions you’re asked honestly. If you’re unsure about something, ask your caseworker for clarification. Remember that your caseworker is there to help you, and providing them with all the necessary information is the best way to ensure a smooth process. Open and honest communication will help you maintain your benefits.

Here are some things to keep in mind when reporting your settlement:

- Notify your caseworker immediately.

- Provide all necessary documentation.

- Complete forms accurately.

- Keep copies of everything you send.

- Ask for clarification if you’re unsure.

Seeking Legal and Financial Advice

It’s essential to seek legal and financial advice when you receive a personal injury settlement, especially if you’re also receiving SNAP benefits. An attorney can help you understand your legal rights and options regarding the settlement. They can also explain the potential impact on your SNAP benefits and advise you on how to proceed.

A financial advisor can help you manage the settlement money wisely. They can provide guidance on investments, budgeting, and other financial planning strategies that may impact your benefits. They can help you understand how to handle your settlement money. This includes helping you set up a budget, save for the future, or make informed financial decisions.

A legal professional can help you navigate complicated legal issues and understand your rights. A financial advisor can provide expert guidance on managing your money. You can make informed decisions and plan for your financial future by seeking professional advice. When dealing with complex legal and financial matters, professional advice can be invaluable.

Here’s what to look for:

- Legal advice from an attorney specializing in personal injury cases.

- Financial advice from a certified financial planner (CFP).

- Look for professionals with experience working with individuals receiving government benefits.

Conclusion

In conclusion, a personal injury settlement can indeed affect your SNAP benefits, but it’s not always a straightforward situation. How your benefits are affected depends on factors like the amount of your settlement, your existing resources, and whether you report the settlement promptly. By understanding how SNAP works, knowing your reporting obligations, and seeking professional advice when needed, you can navigate this process smoothly. Being proactive and staying informed will help you protect your benefits and ensure you can continue to access the food assistance you need.